Winnipeg, Manitoba

January 20, 2004

from Agriculture

and Agri-Food Canada

Market Analysis Division

INTRODUCTION

World wheat prices are expected to

decrease in 2004-2005, assuming a return to normal growing

conditions and higher production in the European Union (EU),

Eastern Europe and the Former Soviet Union (FSU), and normal

growing conditions in the other major wheat producing regions of

the world. World coarse grain and oilseed prices are also

expected to decrease, largely due to increased supplies in the

United States (US). For most of the major crops, domestic

support programs in the US and the EU are expected to continue

to encourage high production which will also pressure prices.

In western Canada, area seeded to spring wheat, coarse grains

and summerfallow is expected to decrease while the area in durum

wheat and oilseeds is forecast to increase, due to the

relatively higher prices expected for 2004-2005. In eastern

Canada, the area of wheat is expected to decline sharply, while

the areas of corn, and to a lesser extent, soybeans, are

expected to increase. Total Canadian production of grains and

oilseeds is expected to increase from about 60 million tonnes

(Mt) to 63 Mt, largely due to higher expected yields in western

Canada. Total exports of grains and oilseeds are projected to

rise marginally in 2004-2005 and imports, dominated by US corn,

are forecast to decrease slightly. Prices for grains and

oilseeds are expected to decrease,

partly due to appreciation of the Canadian dollar relative to

the US dollar. It has been assumed that the trade disruptions

affecting the cattle and beef sector, related to the bovine

spongiform encephalopathy (BSE) cases in Alberta and the US,

will not have a major impact on feed use in 2004-2005.

The market outlook is very tentative since there is a high

degree of uncertainty regarding global supply and demand

conditions. Normal weather patterns have been assumed. World,

and Canadian, stocks of wheat

and coarse grains are low, and serious weather problems in any

of the major importing or exporting countries could

significantly alter the outlook. Ocean freight rates will also

be a major factor to watch in 2004-2005. In Canada, due to low

subsoil moisture conditions in much of the Prairie Provinces,

and low carry-in stocks, precipitation patterns will be a major

consideration. supply.

WHEAT

World wheat (including durum) area harvested for 2004-2005 is

forecast by Agriculture and Agri-Food Canada (AAFC) to increase

by about 4% to 216 million hectares (Mha), slightly above the

5-year average, largely due to higher area in Russia and

Ukraine. Assuming normal growing conditions and average yields,

production is forecast to rise by 7% to 590 Mt, the highest

since 1998-1999, due to higher yields in the EU, Eastern Europe

and FSU from the below-normal crops of 2003-2004. Supplies will

be relatively unchanged with lower carry-in stocks

offsetting the higher production.

World wheat consumption is projected to increase slightly from

2003-2004 due to greater feed use in the EU, Eastern Europe and

FSU resulting from higher production. Human food use of wheat is

expected to be similar to

2003-2004, at 488 Mt, while the use of wheat for animal feed is

expected to rise by 5%, to about 108 Mt. World trade is expected

to increase slightly, to 100 Mt, but remain below the 5-year

average of 107 Mt. Non-traditional exporters, such as Russia and

Ukraine, which exported record quantities in 2002-2003 and

depressed world prices that year, declined sharply in 2003-2004,

and are not expected to significantly increase their market

share in 2004-2005. World carry-out stocks are projected to

decrease by 5%, to 121 Mt, the lowest since 1981-1982 and

well below the 5-year average of 181 Mt.

US winter wheat seeded area has decreased by 3% for 2004-2005,

to 17.6 Mha, with the largest decreases being to hard red winter

(HRW) and soft white winter wheat, due to dry conditions in the

fall, in both the Great Plains and Pacific Northwest states,

resulting in poor germination. Soft red winter (SRW) area is up

slightly, due to strong

wheat prices and production problems with soybeans in 2003-2004.

Seeded areas of spring wheat and durum are forecast by AAFC to

decline slightly. Program payments under the Farm Security and

Rural Investment Act (FSRIA) are expected to support higher

area. Assuming normal abandonment, harvested area of all wheat

is forecast to decline by 7%, to 19.9 Mha. Production is

forecast by AAFC to decrease by 14%, to 54.9 Mt {about 2.02

billion bushels (Gbu)}. A slightly below trend yield of 41

bushels per acre (bu/ac) has been assumed because the HRW wheat

crop is currently in relatively poor condition, due to a lack of

precipitation. However, total wheat supplies are expected to

decrease by only 9% due to higher carry-in stocks.

EU wheat production is forecast to recover by 13% from

2003-2004, to 103 Mt, assuming normal yields, well above the

5-year average of 97 Mt. Carry-in stocks are forecast to decline

by 41%. As a result, EU wheat supplies are expected to increase

by 6% for 2004-2005.

DURUM

World

Durum production is forecast to decline by 2%, to 35.6 Mt, with

increased production in Canada and the EU offset by lower

production in North Africa and the US. The decreased production

will be partly offset by higher major-exporter carry-in stocks,

and world supplies (including major-exporter stocks only) are

expected to be down by 1% at 38.5 Mt. Trade is forecast to

increase by 7%, to 6.2 Mt, assuming a return to lower normal

yields and increased import demand from North Africa, the major

durum importing region. However, world consumption is projected

at 34.6 Mt, and carry-out stocks in the major exporting

countries are forecast to increase by 31%, to 3.9 Mt, above the

5-year average of 3.6 Mt.

PRICES: WHEAT AND DURUM

Although world wheat stocks are expected to decline slightly,

stocks in the five major wheat exporting countries, Canada, the

US, the EU, Australia and Argentina, are forecast to increase by

6% by the end of 2004-2005, to 36 Mt. EU carry-out stocks are

expected to rise by 8% to 8.5 Mt. US stocks are forecast to

increase marginally to about 15.4 Mt, and the US stock-to-use

ratio will rise to 27%, from 24% in 2003-2004. As a result,

world wheat prices are expected to decline in 2004-2005.

US Hard Winter Ordinary (HWO) wheat prices, free on board (FOB)

US Gulf, are forecast to decline to about US$140-150 per tonne

(/t) for 2004-2005 (for the Canadian August-July crop year),

compared to an estimated US$150-160/t for 2003-2004, and

US$161/t in 2002-2003. The price for US Dark Northern Spring

wheat with 14% protein (DNS 14), FOB Pacific Northwest, is

forecast at US$165-175/t, down by about US$5/t from 2003-2004.

Premiums for spring wheat on the Minneapolis Grain Exchange

versus HRW wheat on the Kansas City Board of Trade are forecast

to increase, assuming a decrease in US and Canadian spring wheat

production in 2004-2005. Protein premiums are expected to rise

as well, assuming a return to normal protein levels in the US

and Canadian spring wheat crops from the higher than normal

levels of 2003-2004. High protein Canada Western Red Spring

(CWRS) wheat is generally priced competitively with US DNS 14

wheat, while lower protein CWRS and Canada Prairie Spring (CPS)

wheat are usually priced competitively with US HWO.

World durum prices are expected to decline in 2003-2004, due to

rising stocks in the major exporting countries. Supplies in the

major exporting countries are expected to rise by 9%, to

19.5 Mt, versus the 5-year average of 18.8 Mt. World import

demand is expected to increase due to decreased production in

North Africa, but this will be partly offset by increased

production in the EU. The US No.3 Hard Amber Durum (HAD) price,

FOB St. Lawrence, is forecast at US$170-180/t (August-July),

versus US$180-190/t in 2003-2004.

Export subsidies are not expected to be a significant factor in

the world wheat market in 2004-2005. The US has not used the

Export Enhancement Program since June of 1995, and continues to

make use of credit and food aid programs to stimulate exports,

with loan deficiency payments (LDP) used to support farm prices.

EU stocks remain relatively low, so that export subsidies are

not expected to be aggressive, even with expected increased

production. The value of the euro against the US dollar will be

a major factor in determining the need for export

subsidies.

The average US wheat LDP for 2003-2004 to-date on 21% of the

crop has been US$0.18/bu, versus US$0.16/bu in 2002-2003 on only

6% of the crop, due to lower average farm prices. LDP are

expected to increase further in 2004-2005, due to lower prices.

The loan rate is US$2.80/bu, the same as 2003-2004.

CANADA

Non-durum wheat seeded area is expected to decrease by 4% in

2004, due to relatively low wheat prices in 2003-2004 compared

to oilseeds. Production is forecast to decrease marginally, to

19.1 Mt, assuming near-normal yields of 37 bu/ac. The smaller

production will be offset by higher carry-in stocks, and

supplies are forecast to be relatively unchanged, at 23.3 Mt.

Domestic use is projected to increase by 5%, due to greater feed

use, assuming a return to normal quality in the 2004 crop.

Exports are expected to decline by 2%, to 12.3 Mt, with the

largest declines in Ontario wheat. Carry-out stocks are

projected to be unchanged at an historically low level of

4.2 Mt, versus the 5-year average of 5.5 Mt.

Durum seeded area is projected to increase by 4%, due to

continued premiums over spring wheat in 2003-2004. Production is

forecast to rise by 22%, to 5.2 Mt, assuming a return to a

near-normal yield of 31 bu/ac, from the below-normal level of 26

bu/ac in 2003. Carry-in stocks are projected to rise by 2%, and

durum supplies would increase by 17%, to 6.9 Mt, the highest

since 2000-2001. Despite larger supplies, exports are projected

to rise by only 6%, to 3.6 Mt, since world import demand is

expected to increase by only 0.4 Mt and production in the EU is

forecast to increase, resulting in increased competition for

export markets. Carry-out stocks are forecast to rise by 35%, to

2.3 Mt, versus the 5-year average of 2.0 Mt.

Ontario winter wheat seeded area is estimated by Statistics

Canada to have declined by 25%, to 0.3 Mha, due to lower wheat

prices and a late soybean harvest, which prevented winter wheat

from being planted. Production is forecast by AAFC to fall by

30%, to 1.4 Mt, with exports falling from a projected record

1.1 Mt in 2003-2004 to 0.7 Mt in 2004-2005.

AAFC forecasts the 2004-2005 Canadian Wheat Board (CWB) pool

returns for No.1 CWRS wheat with 11.5% protein at $180/t,

in-store Vancouver or St. Lawrence (I/S VC/SL), $7/t below the

2003-2004 CWB December Pool Return Outlook (PRO). However,

protein premiums are expected to rise and pool returns for No.1

CWRS with 13.5% protein are projected at $195/t I/S VC/SL,

compared to $196/t in 2003-2004. Pool returns for No.1 Canada

Western Amber Durum 11.5% protein are forecast by AAFC at $190/t

I/S VC/SL, compared to the 2003-2004 CWB PRO of $209/t. The

durum premium over spring wheat is projected at only $10/t, the

lowest since 1992-1993.

For more information please contact:

Glenn Lennox

Wheat Analyst

Phone: (204) 983-8465

E-mail: lennoxg@agr.gc.ca

COARSE GRAINS

World production of coarse grains is

expected to increase by 4% due to increased coarse grain

production in the EU and FSU, higher corn production in the US,

South America and China, and larger barley production in Canada.

Supply is expected to decrease marginally as higher production

only partially offsets the lowest carry-in stocks

since 1975-1976. World consumption is forecast to decrease due

to increased supplies of feed wheat. World trade is expected to

increase due to more adequate export supplies in Europe and

stronger import demand from North Africa, the Middle East and

China.

Corn

For US corn, area seeded is expected to increase by 2% from

2003-2004 because of strong current corn prices. Average yields

are expected to be similar to 2003-2004 at 142 bu/ac. Production

is expected to increase to

10.3 Gbu but supplies are expected to increase by only 1% due to

lower carry-in stocks. Domestic use is forecast to increase by

1%, as ethanol production is expected to continue to grow with

new plants beginning production, while feed and industrial use

is projected to drop slightly. Exports are forecast to increase

marginally to 2.0 Gbu, due mainly to less competition from China

in Asian markets. Carry-out stocks are expected to be similar to

2003-2004, with the stocks-to-use ratio dropping from 10% to 9%.

Program payments under the FSRIA are expected to support corn

production in 2004-2005, although farm prices are expected to be

above the loan rate of US$1.95/bu.

In China, corn production is forecast to increase from 2003-2004

due to higher area seeded. This is related to lower carry-in

stocks and higher domestic prices, relative to wheat. Total

supply is expected to decrease. Domestic use is forecast to

continue to increase as a result of increased livestock

production and the ethanol initiatives in

Northeast and Northern China. The historically low supplies are

expected to further cut China’s corn exports. However, China is

expected to continue to export substantial amounts of corn to

neighbouring Asian markets, especially South Korea. China’s corn

exports are forecast to decrease to 4.5 Mt from 8.0 Mt for

2003-2004. Meanwhile, China is likely to import corn from

overseas to serve its fast growing Southern and Eastern markets.

Carry-out stocks are forecast to continue to decline, which will

support world corn prices.

Barley

World barley production is expected to increase from 2003-2004,

as higher production in Europe and Canada more than offsets

reduced production in the US and Australia. Production in the

Middle East, except for Saudi Arabia, and North Africa is

forecast to decrease from 2003-2004 when very good crops were

harvested in these regions. With much of the reduced carry-in

stocks offset by higher production, world barley supplies are

expected to be close to 2003-2004. However, exportable supplies

are forecast to increase from 2003-2004, due to reduced feed

demand for barley in Europe. Higher import demand for feed

barley in the Middle East and stronger import demand for malting

barley in China and, to a lesser degree, in the US are expected

to drive world trade up. Carry-out stocks are expected to

increase slightly.

In Europe, EU barley production is expected to increase by about

7% to 50 Mt due to increased area seeded to barley, as a result

of the decrease in the set-aside requirements from 10% to 5% to

boost EU grain production. Barley production in the FSU and

Eastern Europe is forecast to recover from the weather-affected

2003-2004 to about 35 Mt and 9 Mt, respectively. Increased

production in Europe is expected to more than offset lower

carry-in stocks of 7.7 Mt for 2004-2005 versus 16.2 Mt for

2003-2004. As a result, barley supplies in Europe are forecast

to increase. Demand in Europe is expected to decrease as barley

is replaced by other feed grains, such as wheat and corn which

experienced a significant decrease in production in 2003-2004.

Barley exports from Europe, especially feed barley exports from

the FSU, are forecast to increase, which is expected to pressure

world feed barley prices significantly. The EU is expected to

compete more aggressively with Australia and Canada in the world

malting barley market, such as China, which depresses two row

malting barley prices. EU barley subsidies are not expected to

play a major role in the world barley market in 2004-2005.

In Australia, barley production is expected to decrease slightly

from 2003-2004 while supplies are expected to increase due to

significantly higher carry-in stocks. Larger Australian barley

supplies are forecast to continue to depress world barley,

especially malting barley, prices in 2004-2005.

PRICES

The average farm price for US corn is forecast to decrease to

about US$2.25/bu, compared to the current United States

Department of Agriculture forecast of US$2.30/bu for 2003-2004.

The nearby Chicago futures price is expected to decrease to

US$2.50/bu from US$2.55/bu expected for 2003-2004. This will

cause US Gulf and Pacific Northwest (PNW) corn prices to

decrease and will pressure international coarse grain prices in

general. The average US PNW feed barley price is forecast to

decrease to US$120/t from US$130/t expected for 2003-2004.

Production recovery in Europe, especially in the FSU and Eastern

Europe, is expected to depress EU feed barley prices to the

equivalent of US$130/t from US$150/t expected for 2003-2004.

The average LDP to-date on corn for 2003-2004 has decreased to

US$0.05/bu on 6.8% of the crop from US$0.08/bu for 2002-2003 on

0.02% of the crop. For 2004-2005, LDPs are expected to be low

due to relatively

high US farm prices for corn.

CANADA

Coarse grain harvested area is expected to increase slightly

from 2003-2004 as lower abandonment more than offsets the slight

decrease in area seeded. Production is forecast to increase by

about 5% due to higher yields and increased area harvested.

Although supplies are forecast to increase by 6% due to

increases in production, imports and carry-in stocks, net

exports are expected to fall as a result of lower barley exports

and higher corn imports.

For barley, Canadian production is forecast to increase by 7%.

Farmers are forecast to decrease area seeded to barley by 3%, as

area is shifted away from grains to oilseeds, following the

strong oilseed prices in 2003-2004. Average yields and the

percentage that is harvested for grain are expected to increase

moderately. The area of barley crop that is harvested for fodder

is expected to be below the average in recent history. Average

yields are expected to increase by 8% from 2003-2004, but remain

below trend due to the dry subsoil conditions. Supply is

expected to increase by about 8% from 2003-2004 to 14.9 Mt as a

result of increased production and higher carry-in stocks.

Domestic use of feed barley is expected to rise due to increased

supplies and higher feed demand from the cattle and hog

industries. Imports of US corn are forecast to increase from the

low level for 2003-2004, but still be significantly lower than

the average for the last three years when US corn imports

reached a historical high. Exports of feed barley are projected

to decrease from 2003-2004, due to stronger domestic demand and

diminishing price premium for offshore sales over the domestic

market. Exports of malting barley are expected to increase as a

result of increased production and improved quality in Canada

and stronger import demand from China. Carry-out stocks are

expected to increase to 1.8 Mt, from 1.6 Mt in 2003-2004, but

remain historically low.

Off-Board feed barley prices are forecast to average $125/t (I/S

Lethbridge), the same as for 2003-2004, as much of the increase

in supplies is absorbed by domestic feed demand and exports. The

CWB final pool return for 2004-2005 for No.1 CW feed barley is

forecast by AAFC to decrease by $14/t from the Dec. 2003 PRO to

$145/t I/S VC/SL. The pool return for Special Select Two-Row

designated barley is forecast to decrease from 2003-2004, to

$190/t, due mainly to increased world supplies. The pool return

for Special Select Six-Row designated barley is forecast to

decrease to $180/t. The premium for two-row malting barley over

six-row is expected to be lower than in 2003-2004, as six-row

prices are less pressured than two-row prices by increased

supplies overseas and US imports of malting barley are expected

to remain strong.

For oats, Canadian production is forecast to increase by 10%

from 2003-2004. Exports are forecast to increase as a result of

increased production in Canada and stronger import demand from

the US. Carry-out stocks are projected to increase from

2003-2004, but remain historically low. The average oat price is

expected to remain unchanged from 2003-2004 at $130/t. US

production is expected to decline by about 15% from 2003-2004,

consistent with the long-term trend. Production in the EU is

forecast to increase slightly from 2003-2004 due mainly to

expected production recovery in Sweden. Export subsidies could

be higher than in 2003-2004, especially if both the EU and

Canada produce exceptionally large crops of oats. Oats are

expected to be priced competitively with US corn and the spread

between corn and oats is forecast to remain narrow. Chicago

futures prices are expected to increase marginally from

2003-2004 to US$1.50/bu in 2004-2005, suggesting an average

on-farm price of about $120/t in Manitoba and $105/t in

Saskatchewan.

For corn, Canadian production is forecast to be marginally

higher than in 2003-2004. Area seeded to corn is forecast to

increase by about 5% as area is expected to return from winter

wheat back to corn in Ontario. Yields are expected to decrease

by 5% from the historical high in 2003-2004. Imports are

forecast at about 1.65 Mt, with 1.20 Mt for eastern Canada and

0.45 Mt for western Canada, as high barley supplies are expected

to reduce corn imports from the record highs in the last two

years. Domestic use is forecast to increase by 4% from

2003-2004. The Chatham elevator corn price is forecast to

average $125/t, $5 lower than in 2003-2004, due to lower US

prices and a stronger Canadian dollar. The Chatham-Chicago basis

is forecast to remain similar to 2003-2004, based on projections

for steady demand for imports in eastern Canada.

For rye, production is forecast to increase by 17% from

2003-2004 to 0.38 Mt. The increased area seeded to rye and

higher percentage harvested for grain are expected to more than

offset lower yields. Feed use, industrial use and exports are

forecast to increase due to increased supplies. The on-farm

price for rye is forecast at $105-135/t across the Prairies,

similar to 2003-2004, based on the general trend for coarse

grain prices in Canada. Rye is usually priced competitively with

barley based on its feed value; however, some premiums are

expected

to be offered for rye in Manitoba, and perhaps Alberta, to

attract quality supplies for the food market.

For more information please contact:

Joe Wang

Coarse Grains Analyst

Phone: (204) 983-8461

E-mail: wangjz@agr.gc.ca

OILSEEDS

For 2004-2005, world demand for oilseeds and oilseed products is

expected to continue growing sharply setting new records on

support from increased world demand for protein and fats.

Vegetable oils (vegoils) are the major source of dietary fats

for humans with the worldwide per capita consumption expected to

be about 20 kilograms per year.

World production of the eight major oilseeds is forecast to

increase to a record 360 Mt in 2004-2005. This is due largely to

higher soybean plantings in South America, and higher yields in

the US. Oilseed use is forecast at a record 359 Mt, on support

from increased vegoil and protein meal consumption in China and

India. Trade is expected to increase, to 86 Mt, and carry-out

stocks are forecast at 41 Mt, up from 40 Mt in 2003-2004.

World soybean production is forecast to increase to 212 Mt from

199 Mt expected for 2003-2004, as Brazil, Argentina and Paraguay

continue to increase the area seeded to soybeans, to be

harvested in May 2004. The combined soybean production of Brazil

and Argentina is expected to be about 25% above that of the US.

Strong Chinese demand and the devaluation of the US dollar are

expected to support American exports. Concurrently, the rise in

ocean freight rates is expected to pressure South American

exports of soybeans due to the greater distance from the

European and Asian markets. In the US, production is expected to

rise with a return to normal yields. Seeded area is expected to

increase only slightly, however, as the cumulative result of

several years of disease, agronomic and climatic problems across

various regions of the US. Despite tight carry-in stocks, US

soybeans supplies are expected to increase which will pressure

prices from the high levels of 2003-2004.

World soybean crush is forecast at a record 185 Mt, as China and

Brazil continue to expand processing capacity. China’s soybean

crush, forecast at 32 Mt for 2004-2005, has doubled during the

past five years and, at the current rate of expansion, could

double again within a few years. World soybean carry-out stocks

are forecast to increase slightly to 37 Mt.

World canola/rapeseed production is forecast to increase by 5%,

to 40 Mt due to an expected increase in seeded area in Canada

and Australia as a result of higher returns per hectare compared

to wheat. World trade is expected to rise to about 6 Mt largely

due to increased Canadian exports. Total world canola/rapeseed

crush is forecast to rise to 37 Mt in 2004-2005 on support from

very strong crush margins. Carry-out stocks are expected to fall

to 1.9 Mt.

World flaxseed production is forecast to increase marginally as

farmers plant more flaxseed in response to favourable prices. In

Canada, which is the single largest producer and exporter of

flaxseed, yields are expected to increase sharply, assuming

normal growing conditions in 2004-2005.

PROTEIN MEAL AND EDIBLE OIL

Soymeal production, which represents 70% of world protein meal

production, is forecast at 148 Mt, up from 139 Mt in 2003-2004,

due to higher crush in the US, Brazil, Argentina and China.

Demand for soymeal is expected to increase sharply on support

from the possible ban on animal meal in US livestock rations and

the industrialization of China’s livestock sector. However,

soymeal prices are expected to fall from the expected very

strong levels of 2003-2004 due to increased production.

Edible oil production is forecast at 104 Mt, up from 101 Mt in

2003-2004, due to slightly higher palmoil production and

increased soybeans and canola/rapeseed crushing. Demand for

edible oils is expected to remain strong, particularly in China

and India. Chinese demand for vegoils is forecast to grow

slightly and will be satisfied

through increased domestic crush and increased oilseed, palm

oil, soyoil and canola/rape oil imports.

Palm oil production in Malaysia is expected to grow at a

moderate pace due to the maturation of the palm oil trees and a

slowdown in the planting and replanting of palm trees, which

will be supportive for vegoil prices.

US PRICES

The US on-farm price of soybeans is forecast to fall to

US$6.00/bu from US$7.25/bu for 2003-2004, due to the expected

return of normal yields and production across the US combined

with record high South American

production. As well, soymeal prices are forecast to average

US$200/short ton (st) down from US$235/st in 2003-2004. World

vegoil prices are expected to remain strong with US soyoil

prices forecast to average US$0.23 per pound (/lb) down from the

US$0.28/lb expected for 2003-2004. For 2003-2004 and 2004-2005,

US LDPs are not expected to be significant as local market

prices are expected to remain above the posted county

prices.

CANADA

For canola, seeded area is forecast to increase by 9% to 5.2 Mha

due to the high prices relative to wheat in 2003-2004. Increased

production, forecast at 7.1 Mt from 6.7 Mt in 2003-2004, is

forecast to complement the increase in carry-in stocks,

resulting in a 8% rise in supplies, to 8.4 Mt. Domestic crush is

forecast to remain stable while exports are expected to increase

significantly. Carry-out stocks are expected to increase to

1.25 Mt, while prices are forecast to fall to $345/t from $375/t

expected for 2003-2004.

For flaxseed, seeded area is forecast to increase by 9% to

0.8 Mha due to attractive prices in 2003-2004. As a result of

higher yields, production is forecast at 1.0 Mt, up from 0.8 Mt

in 2003-2004. As well, carry-in stocks are expected to increase,

resulting in significantly higher supplies for 2004-2005.

Exports are expected to rise slightly, to 0.6 Mt while total

domestic usage remains stable. Carry-out stocks are expected to

rise sharply to 0.4 Mt from 0.15 Mt in 2003-2004, with prices

forecast to fall to $315/t from the $350/t expected for

2003-2004.

For soybeans, seeded area is forecast to increase due largely to

decreased winter wheat plantings in Ontario. Average yields are

expected to return to normal and production is forecast to

increase to 2.7 Mt, from 2.3 Mt in 2003-2004. Supplies are

expected to increase modestly due to lower imports, while

exports are expected to remain stable at 0.7 Mt. Domestic

processing is forecast to remain stable because of ample

supplies and reasonable crush margins. Prices are expected to

decline to $280/t, I/S Chatham, from $340/t expected for

2003-2004, largely due to lower US soybean prices and a stronger

Canadian dollar.

For more information please contact:

Chris Beckman

Oilseeds Analyst

Phone: (204) 983-8467

E-mail: beckmac@agr.gc.ca

While the

Market Analysis Division assumes responsibility for all

information contained in this bulletin, we wish to gratefully

acknowledge input from the following: Canadian Wheat Board,

Statcom, Market and Industry Services Branch (AAFC)

The following have been removed from the above bulletin:

1) Canadian Wheat Board - Final Realized Wheat Prices (graph)

2) Canada: Barley and Corn Prices (graph)

3) Canada: Oilseed Prices (graph)

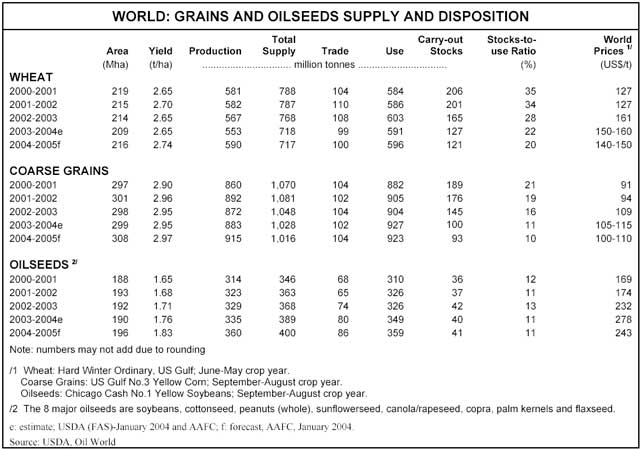

4) World: Grains and Oilseeds Supply and Disposition (table)

© Her Majesty the Queen in Right of Canada, 2004

Electronic version available at

www.agr.gc.ca/mad-dam/

|